Stablecoins & Deposit Tokens

Governed Digital Money for Regulated, Global Settlement

Executive Summary

Digital asset settlement has demonstrated that value can move globally with unprecedented speed and efficiency. Stablecoins, deposit tokens, and other programmable assets now rival traditional correspondent banking in execution. Yet despite these gains, both blockchain-based settlement and legacy financial infrastructure share a fundamental structural weakness: control and security are too often concentrated at a single point of failure.This paper introduces Governed Digital Asset Settlement, enabled by a dual-oracle, dual-control settlement architecture that embeds governance, compliance, and cyber-resilience directly into asset transfers—without centralizing authority, exposing identity data on-chain, or disintermediating existing financial infrastructure.

At the asset level, the TrustSignal Token Governance Oracle operates under the authority of the asset issuer (for example, a stablecoin issuer or regulated financial institution). It enforces programmable rules governing where, how, and under what conditions a digital asset may move. These rules can include jurisdictional constraints, regulatory thresholds, AML and Travel Rule triggers, reporting obligations, and policy-driven transfer limits—ensuring that digital assets remain compliant as they move across borders and regulatory domains.

At the account level, the TrustSignal Wallet Oracle operates under the control of the wallet owner or custodian. This oracle governs how a wallet may transact, enabling fraud prevention, internal controls, role-based permissions, transaction limits, approval workflows, and wallet-level locking. For financial institutions and corporate users, this introduces a form of true decentralized dual control, where custody of funds and authorization to move them are intentionally separated across independent systems.

This separation is critical from a cybersecurity perspective. In traditional finance, account control is typically centralized within a single institution or core banking system. In most blockchain systems, control is centralized within a single private key. In contrast, the TrustSignal architecture requires independent authorization from both the wallet and its governing oracle before a transaction can proceed. Compromising funds therefore requires breaching multiple, distinct control planes—potentially across different technologies, infrastructures, and jurisdictions—dramatically increasing resistance to fraud, theft, insider abuse, and cyber-attack.

For banks, this model extends familiar concepts such as dual authorization, segregation of duties, and internal risk controls into a blockchain-native environment—while preserving the speed, programmability, and atomic settlement properties of digital assets. A wallet holding a deposit token becomes functionally equivalent to a regulated bank account on-chain, yet benefits from stronger decentralization of control than most legacy systems can practically achieve.

Together, the Token Governance Oracle and the Wallet Oracle form a policy-aware settlement layer that bridges public blockchains and regulated finance. Digital assets—whether stablecoins, deposit tokens, or other governed instruments—can move at blockchain speed while remaining jurisdictionally contextualized, institutionally controlled, and secure by design.

Governed Digital Asset Settlement does not replace correspondent banking, RTGS systems, or existing payment rails. Instead, it complements them—extending their reach, reducing de-risking pressures, and enabling new forms of secure, compliant, and cyber-resilient settlement for a global financial system increasingly shaped by both decentralization and regulation.

Author: Hervé Lacorne, Founder & CEO, WorldKYC

1. Crypto Settlement: Speed Without Context

Digital assets and stablecoins enable near-instant global value transfer, but they were not designed to meet regulatory, reporting, or personal security requirements at institutional scale.First, compliance is external to the transaction itself. Public blockchains do not natively enforce AML, CTF, or FATF Travel Rule obligations. Once a token leaves an exchange or platform, there is no embedded mechanism to ensure that sender and receiver information can be validated, reported, or escalated according to jurisdictional rules. Compliance is reconstructed after the fact, rather than enforced as a condition of settlement.

Second, stablecoins were not originally designed as payment instruments. They emerged primarily as hedging tools for crypto traders seeking refuge from market volatility—allowing rapid movement in and out of speculative positions. Their later adoption for cross-border settlement has been opportunistic rather than structural, driven largely by smaller money service businesses and exchanges that lack reliable access to correspondent banking. This usage pattern places stablecoins in roles for which they were never architected.

Third, radical transparency introduces personal security risks. Crypto-native users often assume anonymity on-chain; in reality, anyone with sufficient tooling—including criminals—can identify high-value wallets, trace transaction flows, and target individuals through coercion, extortion, or kidnapping. Privacy is frequently assumed but rarely preserved in a form acceptable to regulated institutions or safe for individuals operating at scale.

Without embedded governance, blockchain settlement remains fast—but unsafe for institutional and commercial use.

Blockchain-based stablecoins enable efficient wallet-to-wallet transfers, and for trading or investment purposes this model works well. Problems emerge when crypto assets are used for payment and settlement, particularly across borders.

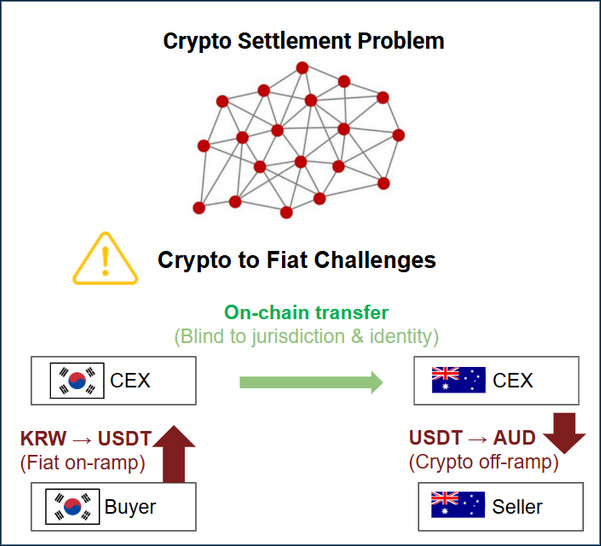

Figure A1 illustrates a common scenario: a Korean importer pays an Australian exporter using a USD-denominated stablecoin such as USDT. While the on-chain transfer itself is near-instant, the compliance burden is concentrated at the fiat–crypto conversion points, especially on the receiving side.

On-ramping fiat into crypto (KRW → USDT) is generally treated as a trading or investment activity and is relatively straightforward. Off-ramping crypto into fiat (USDT → AUD), however, triggers significantly higher regulatory scrutiny. Australian exchanges and financial institutions must assess the provenance of funds, determine whether the transaction is domestic or international, and comply with AUSTRAC reporting obligations. Today, they are largely blind to this information at the moment funds arrive.

Public blockchains do not convey jurisdiction, identity, or regulatory context. A wallet-to-wallet transfer provides no authoritative signal indicating who controls the wallet, under which jurisdiction identity data is held, or whether the transfer should be reported as a cross-border payment. As a result, compliance is performed ex post, after funds have already moved—creating operational, regulatory, and reputational risk for exchanges, counterparties, and regulators alike.

In commercial trade scenarios—such as an importer settling an invoice with an overseas exporter—this uncertainty is amplified. Financial institutions are asked to assess settlement risk without reliable pre-transaction identity, jurisdictional signaling, or policy-aware controls.

In short, ungoverned crypto settlement is fast—but institutionally unsafe.

Without embedded governance, identity context, jurisdictional signaling, and security controls, stablecoins and other digital assets cannot reliably function as regulated payment instruments.

2. Crypto Settlement Solution: Governed Digital Assets

The constraint preventing digital assets from being used in regulated settlement is not the nature of the asset itself, but the absence of governance and control at the point of transfer.While this paper uses a USD-denominated stablecoin (e.g., USDT) as a familiar illustration, the TrustSignal architecture is asset-agnostic. Any digital asset—stablecoin, tokenized commodity, deposit token, or other programmable settlement instrument—can be made suitable for compliant transfer, provided the asset is governed by enforceable policy rules and supported by pre-transaction authorization controls.

In today’s crypto environment, on-chain transfers typically occur without authoritative knowledge of:

- who controls the sending or receiving wallets,

- where identity data is legally held and under which sovereign jurisdiction,

- which regulatory or reporting obligations apply, or

- whether a transaction should proceed automatically or require escalation prior to settlement.

The TrustSignal settlement architecture resolves this structural gap by introducing pre-transaction governance and control, without placing identity data on-chain and without centralizing authority.

Under this model, digital asset transfers are governed through two complementary and independent mechanisms: TrustSignal Token Governance Oracle

Operating under the authority of the asset issuer (e.g., a stablecoin issuer or regulated financial institution), the Token Governance Oracle enforces the policy rules governing the asset itself. These rules may include transfer permissions, jurisdictional constraints, reporting thresholds, escalation conditions, and regulatory triggers. The oracle evaluates whether a proposed transfer complies with the issuer’s ruleset before settlement is finalized.

TrustSignal Wallet Oracle

Operating under the control of the wallet owner or the institution acting as identity custodian, the Wallet Oracle governs how a specific wallet may transact. It enables wallet-level controls such as fraud prevention, internal authorization policies, transaction limits, approval workflows, and wallet locking. This oracle empowers end users and institutions to enforce their own risk and security policies independently of the asset issuer.

Each authenticated wallet is associated with a designated Notary Node, which anchors identity under a sovereign jurisdiction and maintains custody of identity data off-chain. The Notary Node itself does not control transactions; rather, it provides jurisdictional context and legal accountability to the Wallet Oracle, enabling policy enforcement without exposing identity data to the blockchain.

Before a transfer is finalized, the Token Governance Oracle evaluates the transaction against issuer-defined rules. Where required, it relies on the Wallet Oracle associated with the sending wallet to confirm that the transaction is authorized under wallet-level controls. The result is a policy signal—such as allowed, conditionally allowed, or blocked—recorded on-chain without revealing personal or institutional identity data.

Where transactions meet applicable rules, settlement proceeds at full blockchain speed. Where elevated risk states are detected, wallet-level or issuer-level controls can be applied before value moves, enabling compliance enforcement and fraud prevention at the point of settlement rather than relying on ex-post remediation.

This dual-oracle separation ensures that authorization and custody do not reside in a single system or control plane, materially reducing the attack surface for fraud and cyber-compromise.

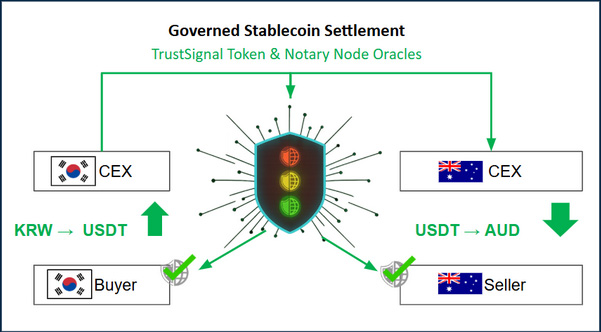

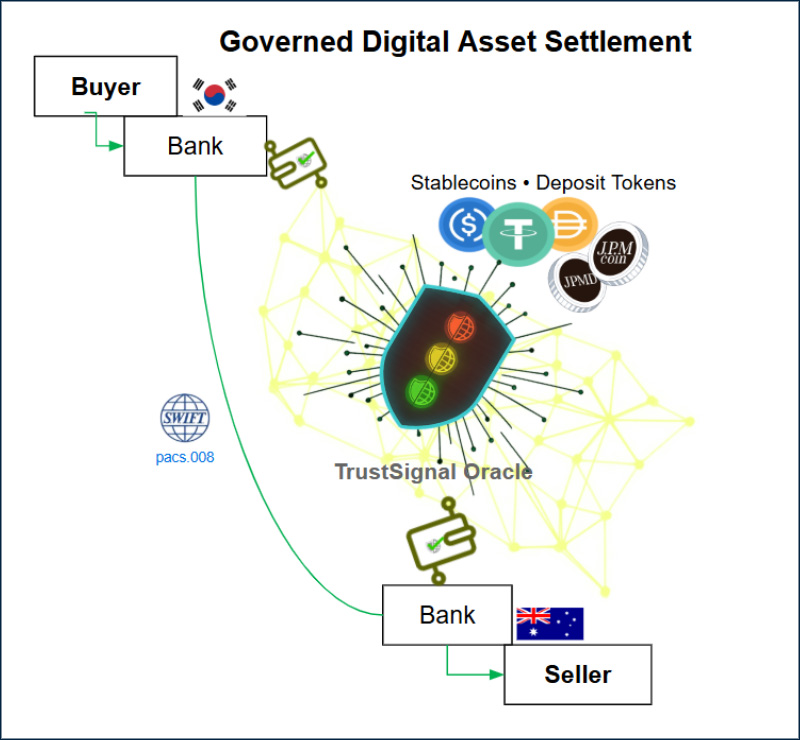

Figure B1 — Governed Digital Asset Settlement Using TrustSignal Oracles

Figure B1 illustrates this governed settlement model. The TrustSignal Oracles sit logically between the sender and receiver, enabling compliant wallet-to-wallet settlement while preserving the efficiency, programmability, and global reach of crypto-native transfers.

This approach transforms digital assets from ungoverned instruments into policy-aware settlement assets. Stablecoins, tokenized commodities, and other programmable assets can be transferred in a manner that regulated institutions can trust—without sacrificing privacy, decentralization, or operational efficiency.

3. The Banking Settlement Problem

Traditional correspondent banking remains the backbone of global payments, yet it is increasingly constrained by structural, regulatory, and operational pressures.Smaller banks, regional financial institutions, and regulated money service businesses—particularly those operating in emerging markets or jurisdictions perceived as higher risk—face ongoing de-risking. Correspondent relationships are reduced or terminated not because of transaction failure, but because of risk appetite, compliance exposure, balance-sheet optimization, or regulatory uncertainty at the correspondent level. When access is withdrawn, these institutions lose reliable pathways to foreign currency liquidity and cross-border settlement.

The consequences are material: reduced financial inclusion, higher settlement costs, delayed payments, trapped liquidity, and increased dependence on a shrinking number of global correspondent banks. Even institutions with sound compliance programs and legitimate trade flows may find themselves excluded due to factors beyond their control.

At the same time, most banks are not positioned to bypass correspondent banking by adopting blockchain settlement directly. Integrating blockchain into core banking operations introduces challenges in compliance enforcement, custody, operational risk management, internal controls, and regulatory oversight. Many institutions lack the human capital, technical infrastructure, and governance frameworks required to safely manage on-chain settlement within a regulated environment.

As a result, some institutions and their customers resort to digital assets and stablecoins as informal settlement workarounds—often outside regulated banking channels and without embedded governance, reporting, or risk controls. While these approaches may restore transactional continuity in the short term, they introduce new regulatory, operational, and compliance risks that banks are neither equipped nor authorized to manage.

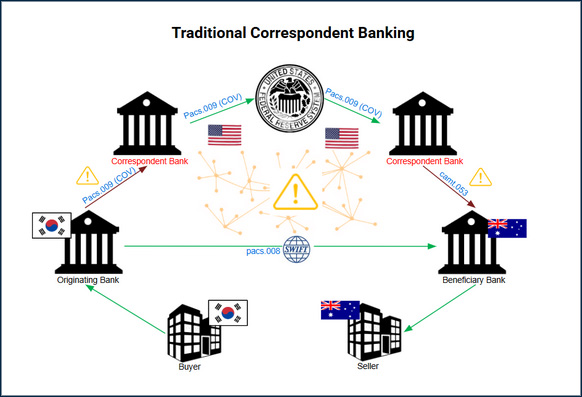

Figures A2-1 and A2-2 illustrate this tension by contrasting correspondent banking under normal conditions with its failure mode under de-risking pressure.

Figure A2-1 Traditional Correspondent Banking with Intact Relationships.

An originating bank sends a SWIFT payment message to a beneficiary bank, typically via one or more correspondent banks that provide access to foreign currency liquidity and settlement rails. Central bank systems (e.g., Fedwire or equivalent RTGS platforms) process settlement once correspondent access is available.

When correspondent relationships are intact, this model is operationally effective and well understood. However, it depends on pre-funded Nostro/Vostro accounts, jurisdictional risk tolerance, balance-sheet capacity, and the continued willingness of correspondent banks to intermediate the transaction.

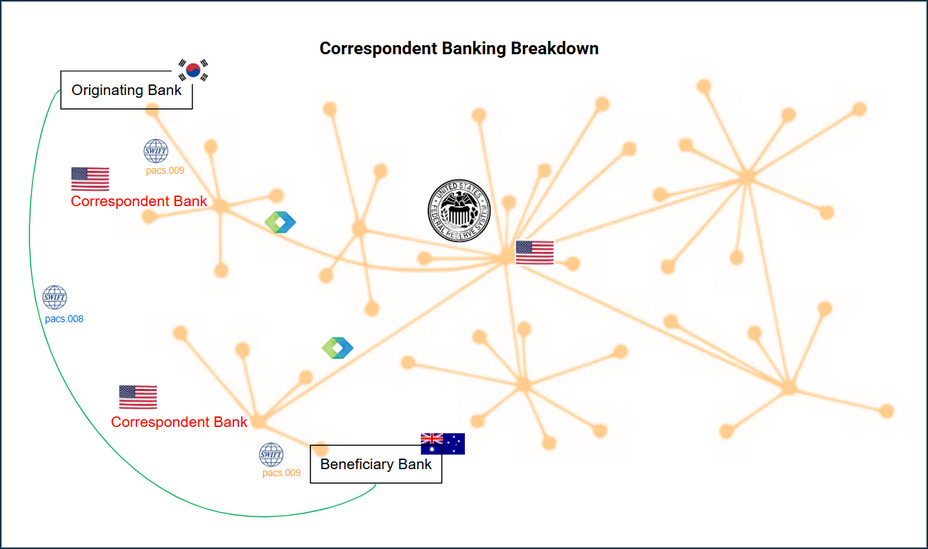

Figure A2-2 Correspondent Banking Breakdown Under De-Risking Pressure.

Even when SWIFT messaging infrastructure and central bank settlement systems function correctly, the withdrawal or restriction of a single correspondent relationship can halt settlement entirely. Messaging continues, but value cannot move.

This failure mode is not caused by technical error, but by governance and risk decisions taken upstream—often outside the control of the originating or beneficiary bank. The result is a fragmented system in which payment instructions circulate, but settlement is blocked.

This dynamic disproportionately affects smaller banks, regional institutions, and regulated entities operating in emerging or higher-risk jurisdictions. Without reliable correspondent access, they are forced to delay settlement, route transactions through opaque intermediaries, or seek alternative mechanisms that sit outside traditional banking oversight.

4. Banking Settlement Solution: Deposit Tokens with Dual-Oracle Control

Deposit tokens extend regulated bank deposits onto blockchain infrastructure without altering the legal nature of the underlying funds. The tokenized deposit remains a liability of the issuing bank and continues to fall under existing banking supervision, prudential regulation, and customer protection frameworks. Rather than introducing a parallel compliance regime, deposit tokens project existing banking controls into a programmable settlement environment.When governed through the TrustSignal dual-oracle settlement architecture, deposit tokens enable banks to access blockchain settlement efficiency while preserving institutional control, regulatory alignment, and cyber-resilience.

The core enabler is embedded, pre-transaction governance, enforced through a dual-oracle model:

The TrustSignal Token Governance Oracle, operating under the authority of the issuing bank, enforces asset-level rules governing where, how, and under what conditions a deposit token may move. These rules may include jurisdictional constraints, regulatory thresholds, reporting triggers, corridor restrictions, and optional linkage to existing financial messaging and reporting systems (including SWIFT UETR references).

The TrustSignal Wallet Oracle, operating under the control of the wallet owner and anchored to a designated Notary Node, governs how a specific wallet may transact. This oracle enforces account-level controls such as authorization logic, transaction limits, approval workflows, and fraud-prevention policies—without placing identity data on-chain.

Together, these two oracles ensure that settlement is both asset-compliant and account-controlled before value moves.

Critically, the Wallet Oracle enables governance based on the attributes of the wallet holder, rather than relying solely on transaction metadata. These attributes are attested by the designated Notary Node and made available to the governance layer without exposing underlying identity data.

This includes age-based controls, where a wallet associated with an individual can be verified as belonging to an adult, a minor, or a supervised account. Banks issuing wallets to retail customers can therefore enforce age-dependent permissions, guardianship rules, or transaction restrictions—mirroring existing account-opening and consumer protection obligations in traditional banking.

More importantly for institutional settlement, the Wallet Oracle enables authoritative differentiation of entity type. A wallet may be attested as belonging to:

- a natural person,

- a regulated financial institution,

- a corporate entity,

- a non-profit organization, or

- another legally defined entity class.

In practice, a wallet holding a deposit token becomes functionally equivalent to a regulated bank account on-chain, but with stronger decentralization of control than legacy systems can provide. Authorization to move funds and custody of funds are intentionally separated across independent systems—potentially across different technologies, servers, and jurisdictions.

This separation delivers a significant cybersecurity advantage. In traditional banking, account control is centralized within a single institutional system. In most blockchain systems, control is centralized within a single private key. Under the TrustSignal model, compromising funds requires breaching both the wallet and its oracle-based control plane. This dramatically raises the barrier to fraud, insider abuse, and external cyber-attacks, while preserving operational efficiency.

Importantly, this model does not require banks to redesign core banking systems or hire specialized Web3 teams. Middleware platforms abstract blockchain complexity, allowing deposit tokens to integrate seamlessly with existing payment workflows, risk systems, and reporting processes.

Figure B2 — Regulated Bank Settlement Using Deposit Tokens and TrustSignal Oracles

Figure B2 illustrates how governed digital assets enable regulated bank settlement while preserving existing financial messaging infrastructure. Institutions continue to generate standard SWIFT messages (e.g. pacs.008) through their existing systems, while settlement is executed on-chain using deposit tokens or governed stablecoins.

The TrustSignal Token Governance Oracle enforces asset-level regulatory rules, while the TrustSignal Wallet Oracle applies account-level controls and fraud prevention before settlement occurs. This decoupling of messaging and settlement allows correspondent-style payments to proceed even where traditional correspondent liquidity is constrained, expanding—not replacing—the role of SWIFT by enabling higher transaction volumes, faster settlement, and reduced de-risking pressure across jurisdictions. In future implementations, SWIFT settlement references (including pacs.009 COV-style constructs) may be programmatically linked to on-chain settlement events for reconciliation and regulatory reporting.

5. Privacy, Fraud Prevention, and Sovereign Identity Control

Blockchain transparency does not equal privacy—and privacy without control does not equal security.In both traditional finance and most blockchain systems today, authorization and control remain concentrated within a single system or credential, creating a structural single point of failure.

The TrustSignal architecture, grounded in a sovereign identity framework, introduces decentralized dual control by separating custody of value from authorization to move it.

At the wallet level, the TrustSignal Wallet Oracle operates under the control of the wallet owner or managing institution. This oracle enforces wallet-specific policies before any transaction is authorized, enabling fraud prevention, internal governance, and cybersecurity controls that are independent from the blockchain itself. These controls may include transaction limits, role-based permissions, approval workflows, time-based restrictions, age or capacity constraints, entity-type restrictions, and wallet-level locking.

At the identity custody level, each wallet is anchored to a designated Notary Node, operating under a specific sovereign jurisdiction chosen by the wallet owner or institution. The Notary Node does not authorize transactions; it anchors identity custody and jurisdictional authority that the Wallet Oracle references when enforcing wallet-level policy. Identity data remains strictly off-chain and under local legal control. The blockchain never receives personal or institutional identity data—only cryptographic attestations, jurisdictional signals, risk states, and policy outcomes.

This distinction is critical. Controlled disclosure is not global—it is jurisdictional.

Disclosure of identity information can occur only under the laws and legal processes governing the sovereign jurisdiction of the Notary Node holding custody of that identity, and only through authorized legal or regulatory procedures. This mirrors how legal contracts, financial accounts, and regulated custodians operate today: accountability exists, but only within an explicitly defined legal framework.

As a result, the TrustSignal model delivers:

- Anonymity with accountability, where wallets remain pseudonymous on-chain but legally attributable off-chain

- Fraud prevention through dual control, requiring authorization across independent systems

- Cyber-resilience, where compromising a private key alone is insufficient to move funds because authorization is enforced across an independent oracle control plane

- Wallet-level governance, enabling differentiation between individuals, corporates, non-profits, and regulated financial institutions

- Jurisdiction-aware compliance, without exposing identity data on-chain

Crucially, this architecture reflects and extends principles already used in high-value financial systems, where settlement networks are deliberately separated from customer identity systems to reduce systemic risk, including RTGS and high-value payment architectures. By embedding this separation directly into digital asset settlement, TrustSignal enables wallets—whether held by individuals or institutions—to function as secure, policy-governed accounts on-chain.

Sovereign identity is the foundation that makes this possible. The TrustSignal framework builds on the principles described in Digital Identity 2.0—where identity remains private, jurisdictionally anchored, and legally enforceable without being centralized or exposed.

(See: https://www.worldkyc.com/en/wp-25)

In this model, privacy is not achieved through obscurity. It is achieved through sovereign identity control, policy enforcement, and intentional separation of powers—delivering security, resilience, and accountability that neither traditional finance nor conventional blockchain systems can provide alone.

6. Interoperability and Optional CLS-Like Communities

Governed digital assets enable interoperability not by sharing infrastructure, but by sharing common governance rules.When deposit tokens—or other governed digital assets—are issued under compatible Token Governance Oracle rulesets, they can participate in decentralized, CLS-like settlement communities without requiring centralized clearing houses or exclusive correspondent hubs.

Under this model, participating institutions agree on a shared policy framework—covering eligibility, jurisdictional constraints, settlement thresholds, escalation rules, and reporting requirements—while retaining full control over their own wallets, identity custody, and internal controls. Settlement coordination is achieved through rule alignment, not through pooled custody or centralized balance sheets.

Within such communities, institutions may optionally net obligations on-chain within predefined governance parameters before triggering final settlement. This netting can occur without exposing counterparty identities on-chain and without requiring prefunding across multiple correspondent accounts. Final reconciliation may then occur via existing RTGS systems, including central bank money or other regulated settlement rails.

Crucially, participation in these communities is no longer limited to tier-one banks. Regulated financial institutions, licensed MSBs, and other supervised entities may participate provided they comply with the governing Token Oracle rules and operate wallets protected by TrustSignal Wallet Oracles. This expands access to efficient cross-border settlement while preserving regulatory accountability.

Multiple settlement communities may coexist simultaneously. A single governed digital asset—whether a deposit token or a regulated stablecoin—can be used across different networks, jurisdictions, or corridors without fragmentation. Institutions are free to participate in one or more communities based on their risk appetite, regulatory permissions, and operational needs.

This approach mirrors the functional benefits of CLS—reducing settlement risk and liquidity strain—while avoiding centralized concentration of control. In banking terms, this directly addresses Herstatt risk—the risk that one leg of a cross-border settlement completes while the counter-leg fails or is delayed after value has already moved—by enabling coordinated, policy-enforced settlement across jurisdictions without centralized prefunding or clearing dependency. In crypto-native terms, this achieves atomic settlement: either the governed transaction completes in full under policy, or it does not execute at all. Settlement risk is mitigated through governance enforcement, dual control, and jurisdictional anchoring, rather than through a single global intermediary. This ensures that settlement finality is achieved simultaneously across legs, eliminating principal risk for banks and execution risk for crypto-native participants.

Importantly, this model does not disintermediate existing financial infrastructure. On the contrary, it complements and extends it. By enabling governed digital assets to interoperate with traditional messaging and reporting standards—such as SWIFT and ISO 20022—these communities are expected to increase settlement volumes flowing through existing financial networks, not replace them.

In this sense, governed digital asset settlement creates a bridge between decentralized efficiency and regulated interoperability—allowing financial institutions to move value faster, with lower liquidity friction, while remaining firmly within established legal and supervisory frameworks.

Why this matters now is simple: global settlement is increasingly fragmented between legacy payment rails and blockchain-native liquidity. Traditional systems reduce risk through centralization and prefunding, while decentralized systems optimize speed but externalize risk. Governed, oracle-enforced settlement communities reconcile these models—allowing institutions to reduce settlement risk, liquidity strain, and de-risking pressure while preserving interoperability with existing RTGS and messaging infrastructure. This creates a credible path forward for regulated institutions to participate in digital settlement networks without abandoning the controls that global finance depends on.

7. Stablecoins, Deposit Tokens, and the Regulatory Horizon

Deposit tokens operate fully within existing banking regulation, while stablecoins and other digital assets increasingly face bespoke regulatory regimes such as MiCA in the European Union, the GENIUS Act in the United States, and proposed market-structure legislation such as the Digital Asset Market Clarity Act (CLARITY Act). These frameworks differ in scope and intent, yet they all reflect the same underlying challenge: how to align fast, programmable digital assets with regulatory oversight, reporting obligations, and risk controls.In the United States, the CLARITY Act seeks to define regulatory boundaries between the SEC and the CFTC, establish conduct standards for exchanges and intermediaries, and clarify the classification of digital assets in secondary markets. While such legislation is essential for venue supervision, investor protection, and market integrity, it does not address how individual transactions are governed, authorized, or secured at the point of settlement.

This distinction is critical. Market-structure regulation governs where assets trade and who supervises intermediaries, but settlement risk, compliance, and fraud prevention occur at the transaction level. Without embedded governance at the moment value moves, regulatory clarity alone cannot prevent post-trade remediation, de-risking, or operational breakdowns.

Governance oracles provide a convergence point across regulatory regimes. By enforcing policy rules at the asset level and control rules at the wallet level, governed digital assets can meet compliance, reporting, and fraud-prevention requirements regardless of whether the underlying instrument is a deposit token, a stablecoin, or another programmable asset. This allows existing assets and infrastructures to evolve without requiring wholesale replacement or regulatory arbitrage.

As a result, traditional financial institutions and crypto-native ecosystems converge not by adopting the same regulatory labels, but by sharing a common, policy-aware settlement layer. Governed digital asset settlement enables blockchain-based transfers to operate at global scale while remaining jurisdictionally contextualized, institutionally controlled, and resilient across an evolving regulatory landscape.

8. Conclusion: Governance Is the Missing Layer

The future of digital money is not constrained by technology, but by governance. Blockchain settlement is already faster, cheaper, and more programmable than legacy financial infrastructure. What has been missing is a credible framework for accountability, compliance, and cyber-resilient control at the exact moment value moves.Governed digital assets—whether stablecoins, deposit tokens, or other programmable instruments—address this gap by embedding governance directly into settlement. When paired with programmable token rules and wallet-level control enforced through TrustSignal oracles at both the asset and wallet layers, digital assets gain the institutional properties required for real-world finance: jurisdictional context, enforceable policy, fraud prevention, and auditable outcomes—without exposing identity data on-chain or centralizing authority.

At the asset level, token governance ensures that rules travel with value: where an asset may move, under what conditions, and with which reporting or escalation requirements. At the wallet level, decentralized control restores a principle long embedded in banking but absent from most blockchain systems—dual authorization across independent control planes. Settlement no longer depends on a single private key or a single institution, but on coordinated approval across distinct control systems, jurisdictions, and technologies.

This architecture delivers a fundamental cybersecurity upgrade. Compromising funds no longer requires breaching one system, but multiple independent controls operating across separate authorization planes. Fraud prevention, internal governance, and personal security become proactive rather than reactive. Wallets—whether held by individuals, corporations, or financial institutions—gain programmable safeguards that mirror and extend traditional concepts such as segregation of duties, approval workflows, and account-level controls.

Crucially, this convergence does not replace existing financial infrastructure—it completes it. Governed digital asset settlement complements correspondent banking, RTGS systems, and messaging networks such as SWIFT by reducing settlement risk, easing de-risking pressures, and enabling new forms of compliant, near-instant value transfer at global scale. Legacy systems retain their role; blockchain extends their reach.

Why this matters now is evident. Regulatory frameworks are accelerating, cross-border payments remain fragmented, and cyber threats increasingly target both institutions and individuals. At the same time, digital assets are no longer experimental—they are already moving real value at global scale. Without embedded governance and decentralized control, that scale will remain constrained by risk.

Digital money becomes viable at institutional scale not by bypassing regulation, nor by centralizing control, but by embedding governance, security, and accountability directly into settlement itself. That is the role of governed digital assets—and why the TrustSignal architecture marks a critical step toward a secure, interoperable, and resilient global financial system.

Stablecoins & Deposit Tokens

Governed Digital Money for Regulated, Global Settlement